This can be a section from the 0xResearch publication. To learn full editions, subscribe.

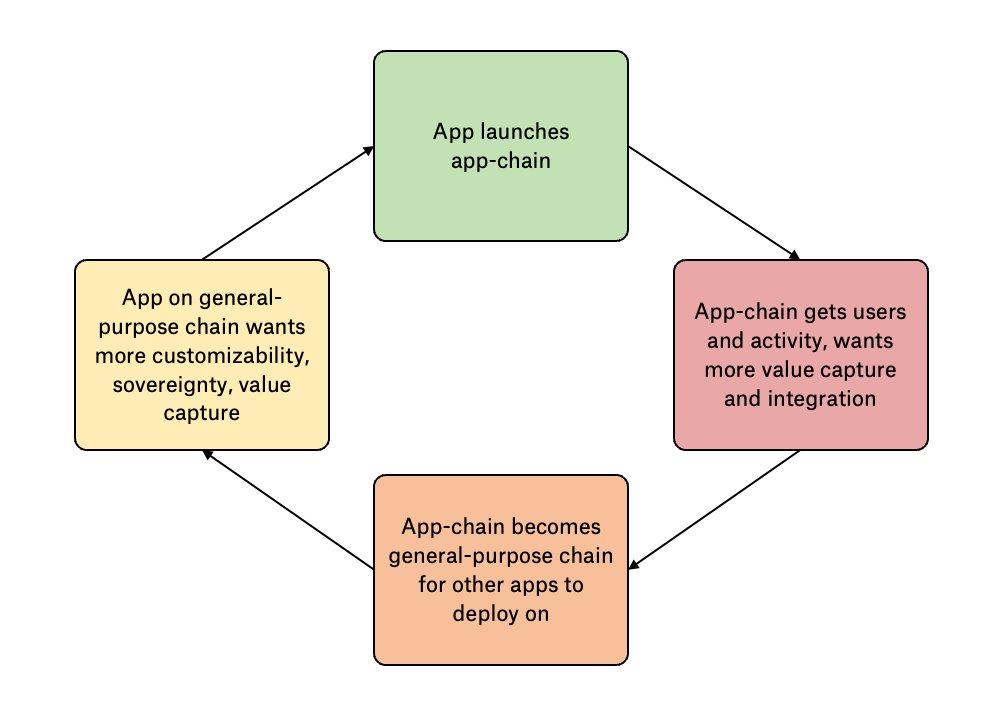

Right here’s a standard paradox L1s face as we speak:

L1s wish to allow application-specific L2 chains as a result of each app can’t coexist in the identical blockchain surroundings. Builders need freedom to customise.

However when each appchain is making their very own unbiased design choices, you may have fragmentation. Then they depart your L1.

Ethereum, Cosmos, Avalanche and Polkadot have all suffered from related issues.

Initia’s structure

Initia, which is launching its mainnet as we speak, is decided to run again the identical appchain imaginative and prescient whereas avoiding the pitfalls of fragmentation.

Appchains that select to construct on Initia profit from a tightly built-in and opinionated tech stack — what Initia calls the “Interwoven Stack.”

All Initia appchains are constructed with the identical stack and requirements. They share a canonical bridge (LayerZero), cross-chain messaging (Cosmos IBC), underlying framework (Cosmos SDK) and standardized gasoline token (native USDC by way of Noble is the default although chains can change it) throughout chains, in addition to and knowledge availability layer (Celestia).

Appchains can run on whichever execution surroundings they like. Of the 18 introduced groups constructing on the Interwoven Stack, they’re usually evenly break up between the EVM, MoveVM and WasmVM, Initia’s co-founder Zon informed me.

They’ll additionally leverage frequent MEV infrastructure like POB (Protocol Owned Builder) and Protorev to seize non-toxic MEV, use a standard enshrined oracle (Join), a standard multisig (Initia Multisig), block explorer (Initiascan) and area title service (Initia Username).

You get the thought — it’s each important public good attainable to permit an ecosystem of differently-minded builders to run on frequent requirements with out struggling fragmentation.

OK, nicely what in regards to the L1?

The Initia L1 runs on the MoveVM and CometBFT consensus with single slot finality and a 500 ms blocktime.

The L1 is supposed to behave as a liquidity hub, very very similar to what Cosmos Hub aspired to be.

What retains liquidity on the L1? INIT token holders can stake INIT on the L1 to earn inflationary staking rewards, in addition to buying and selling charges on Minitswap, the L1’s native DEX.

There isn’t a payment charged to move by way of the hub proper now, although which may be built-in down the highway, the Initia staff mentioned.

That is known as “enshrined liquidity,” which successfully permits INIT tokenholders to learn from each staking rewards in addition to act as a liquidity supplier — a restaking of types.

What would deter profitable Initia appchains from leaving Initia to create their very own chains?

For one, appchains have already got full customization over their surroundings and are in a position to internalize their very own MEV.

Secondly, Initia appchains will not be the identical as general-purpose L2 rollup chains, so their native tokens will probably exist on the L1 the place probably the most liquidity is.

“They’re not going to launch a DEX on their chain as a result of that’s not what their appchain is for,” Initia co-founder Stan mentioned.

Lastly, Initia explicitly rewards appchains with INIT rewards primarily based on TVL and governance metrics as a part of its Vested Curiosity Program (VIP). Customers earn INIT primarily based on standards set by L2s.

The VIP program is what Initia hopes will stave off the shortage of worth accrual that ATOM suffered from.

“The best downfall for ATOM was the truth that Cosmos customers didn’t take care of the token itself. Cosmos appchains didn’t have a robust purpose to combine ATOM.”

To be honest, these aren’t significantly unique mechanics. Initia’s VIP rewards have placing similarities to Berachain’s “proof-of-liquidity” or Blast’s “Gold” marketing campaign. MEV seize is being pursued by many different ecosystems/apps. Arbitrum introduced customized gasoline tokens as we speak.

What is probably unique is the holistic mixture of all of those design decisions from day one to keep away from the various issues of worth accrual which have plagued ATOM or ETH.

Initia launch

Initia has raised $25m in whole by way of three non-public rounds and a $2.5m Echo spherical in September 2024.

In response to Initia’s press launch, there are at the very least 18 groups which can be constructing on its Interwoven Stack. These groups have collectively raised $28m, notably greater than Initia’s personal increase. I observed the same sample with MegaETH. Is the fats protocol thesis lifeless?

Anyway, INIT goes stay as we speak. Listed below are its tokenomics.