Oracle’s inventory worth tanked after a brand new report on its revenue margins, and there are critical attainable implications for AI. Crypto’s market cap additionally declined afterward, but it surely’s laborious to foretell the total fallout.

LLM builders and varied AI infrastructure pursuits are at the moment engaged in an enormous wave of round financing, however one collapse might trigger extra issues. The AI bubble could also be in peril of popping quickly.

Oracle Inventory and AI Fortunes

Just lately, Oracle Corp, an American database and AI cloud infrastructure agency, was having fun with a second within the solar, with robust quarterly earnings and spectacular inventory efficiency. Nonetheless, the corporate’s fortunes took a flip at the moment, with its inventory all of the sudden plummeting dramatically:

Oracle Corp Worth Efficiency. Supply: Google Finance

All informed, this crash represented one thing like a $40 billion drop within the agency’s complete market cap, a very staggering determine. Oracle’s worth dip additionally prompted a corresponding decline within the complete crypto market cap, so now we have loads of causes to analyze this intently.

AI and crypto markets are totally entangled in at the moment’s surroundings, and additional hassle at Oracle might rebound on this trade. Most social media chatter agrees {that a} new report from The Data prompted this downturn.

Though the corporate places out bullish monetary knowledge, a bit scrutiny confirmed some critical underlying issues.

For one factor, Oracle apparently has razor-thin revenue margins on its AI cloud companies, profiting roughly 14 cents for each $1 in Nvidia server leases. Typically, these tiny margins slip below viability, inflicting big losses.

For instance, within the final quarter, Oracle misplaced $100 million renting out Blackwell chips, which is theoretically a cornerstone of its AI enterprise.

Is a Larger Crash Coming?

In different phrases, the problem isn’t that Oracle can’t discover enough patrons for its choices; moderately, AI infrastructure is outwardly much less worthwhile than marketed. Certain, many AI companies freely admit that they’re shedding cash, however this looks as if greater than a setback.

Will these platforms ever be worthwhile, even below superb circumstances?

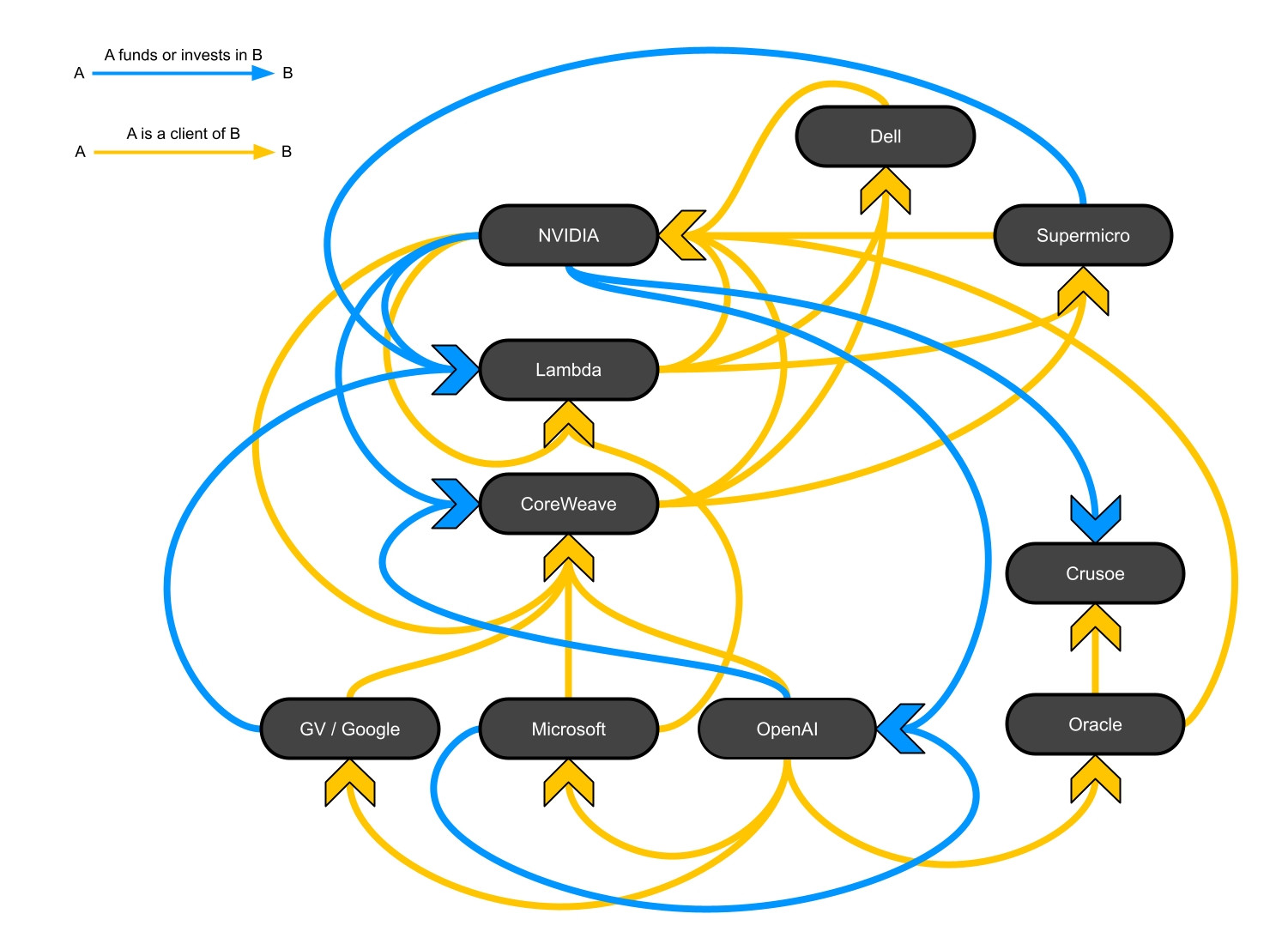

This drawback is compounded by the rampant round financing in at the moment’s crypto trade. LLM builders make big and influential investments into chip producers, who in flip make main enterprise offers.

Oracle shouldn’t be the centerpiece of this AI funding internet, but it surely’s definitely a serious element:

Round Financing in AI. Supply: Anthony Restaino

In different phrases, the notion that AI is in a bubble is changing into generally accepted, and an Oracle crash could be the factor to pop it. These corporations are experiencing runaway funding and inventory features, however hypothesis alone gained’t final perpetually.

Hopefully, the crypto market can keep away from a number of the fallout.

The publish Oracle and Crypto Shares Crash After Report on AI Revenue Margins appeared first on BeInCrypto.