Binance Analysis simply launched a report on the DeFAI sector, detailing the primary tendencies on this outstanding space. It describes 4 key areas, all of that are instantly associated to AI brokers.

The report reveals that meme cash largely dominate the AI crypto market share, however DeFAI is rising quick.

Binance Analysis Research DeFAI

Binance’s research-focused arm routinely compiles insightful research on the business because it stands. Right now, it continued the pattern, as Binance Analysis launched a report on DeFAI, referring to it as the way forward for on-chain finance altogether:

“The combination of synthetic intelligence into crypto is transferring quickly from novelty to infrastructure. What started with experiments… has begun to evolve right into a deeper, extra systemic transformation of how decentralized finance (DeFi) is constructed, used, and scaled,” the report started.

DeFAI, the combination of AI and decentralized finance, has been rising in prominence for a number of months now. Nonetheless, it’s at present fairly removed from the forefront of the AI business.

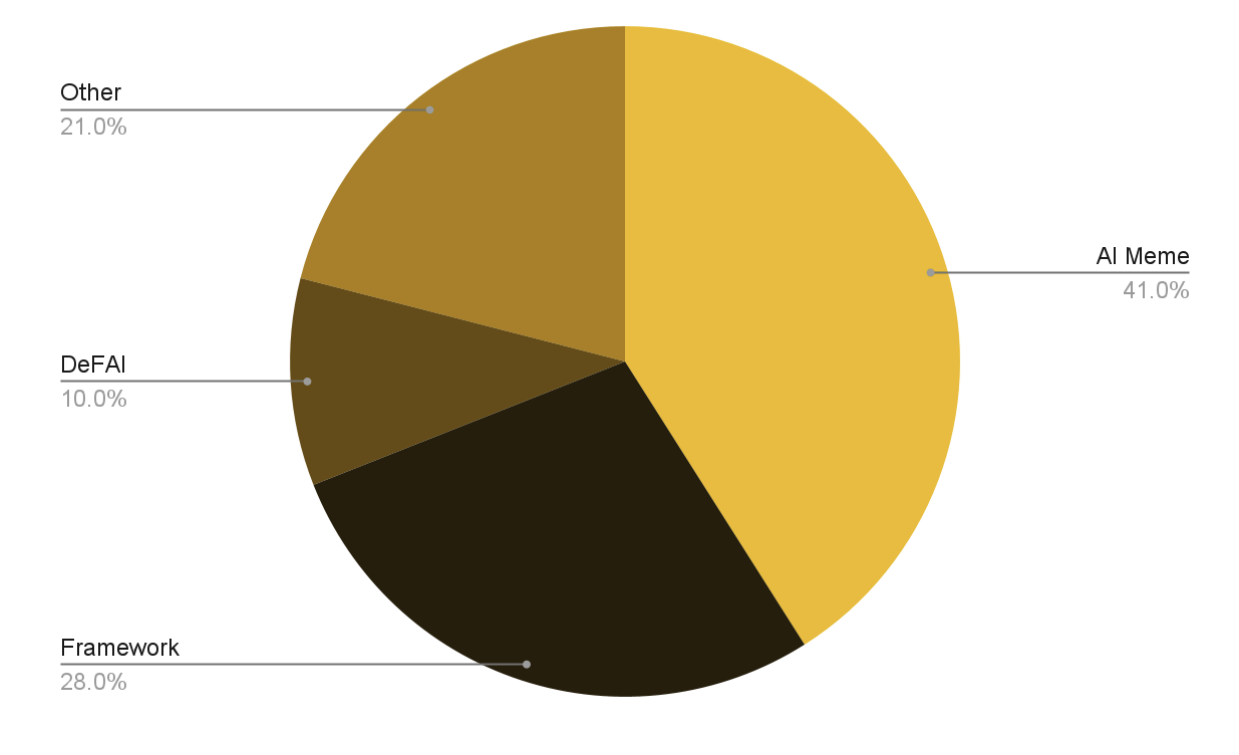

Binance Analysis broke down the market cap of assorted AI subsectors, figuring out that DeFAI solely represents 10%. Thus far, AI meme cash are way more outstanding.

Crypto’s AI Market Cap Dominance. Supply: Binance Analysis

Nonetheless, Binance claimed that AI brokers will energy DeFAI’s success in the long term. It described 4 key architectural layers in DeFAI, all of that are associated to AI brokers.

These embrace the brokers themselves, frameworks that decide their design, protocols to assemble them, and marketplaces to distribute them. The report additionally explored a number of examples of every.

A number of current developments corroborate these daring claims. For instance, AI brokers just lately expanded in quantity regardless of a bear market and pulled forward of the business after they made a rebound.

Earlier in the present day, Tether introduced QVAC, a serious challenge which might probably match Binance’s definition of a DeFAI agent framework or protocol, relying on unreleased specifics.

Wanting ahead, Binance Analysis identified a couple of potential issues for the DeFAI sector. Two vital concerns are possession and transparency, each near the crypto neighborhood’s sensibilities.

It additionally questioned the extent to which AI brokers ought to instantly take part in decentralized governance. As brokers propagate by way of all the pieces, the potential for abuse will solely develop.

To sum up, Binance Analysis strongly believes in DeFAI’s potential. These brokers are autonomous, modular, and intelligently decentralized, which might deliver large advantages alongside potential dangers.

Nonetheless, so long as human actors implement robust safeguards and requirements, these instruments may create crypto’s future.