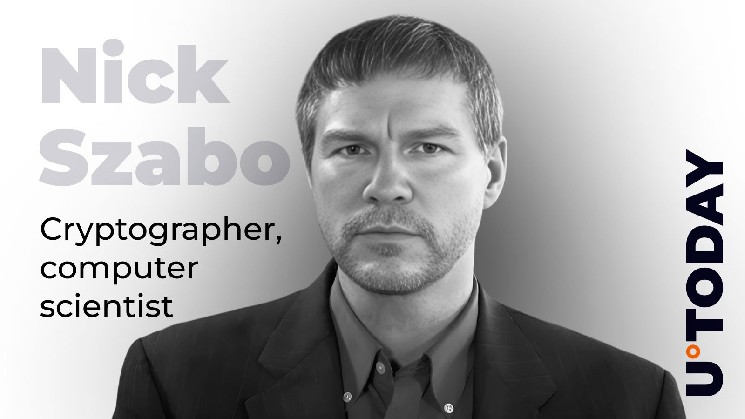

Nick Szabo, a distinguished pc scientist identified for introducing the idea of good contracts, claims that “a basic drawback” with Ethereum’s valuation is that its use circumstances are “largely exterior” to the market worth of the favored cryptocurrency.

As Szabo explains, Ethereum apps can garner nice income, however the ETH value would stay comparatively low (or vice versa).

In truth, the cryptographer is definite that there’s truly barely any connection between the Ethereum (ETH) value and its utility.

Then again, Bitcoin’s primary use case is particularly a retailer of worth (SOV), which is “strongly linked” to the value of the main cryptocurrency.

Since ETH can’t correctly mimic Bitcoin’s SOV use case, it has to depend on different use circumstances that aren’t instantly linked to its value.

Narrative-driven rally

Szabo’s remark comes after Syncracy Capital co-founder Ryan Watkins famous that Tom Lee’s Bitmine was the primary factor that was capable of push the value of ETH from $1,400 to $5,000 in a matter of months.

Earlier this 12 months, Ethereum was thought of to be a “dying” platform, however the narrative has dramatically modified.

“It’s a recreation of flows and narratives till the occasion stops,” Watkins added.

Ethereum’s rally

On Monday, the value of ETH surpassed the $4,700 degree as soon as once more.

The cryptocurrency not too long ago logged its best-performing Q3 so far, and it’s on observe to report yet one more stellar This fall.