Whereas institutional curiosity in altcoins continues to extend after Bitcoin, Ethereum (ETH) is among the most most popular altcoins.

As institutional ETH purchases proceed, establishments and corporations’ Ethereum holdings have surpassed 10% of the whole provide. Consultants consider this is a sign that the institutionalization of the Ethereum market is progressing quickly.

In response to information from StrategicETHReserve, Ethereum treasuries maintain roughly 5.66 million ETH, whereas spot Ethereum ETFs maintain roughly 6.81 million ETH. Whole institutional holdings, in response to the information, have risen to 12.48 million ETH, representing 10.31% of the Ethereum provide.

The surge in ETF inflows in latest months has coincided with a surge in corporations modeled after the most important institutional bull, Technique (previously MicroStrategy), and public corporations like BitMine and SharpLink including massive quantities of ETH to their stability sheets.

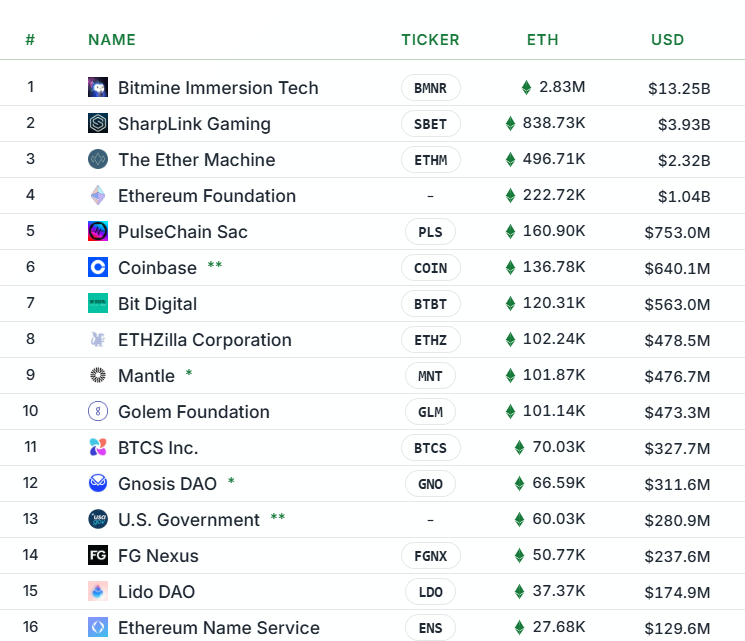

In response to StrategicETHReserve information, the most important institutional Ethereum firm is Bitmine, headed by Tom Lee, with 2.83 million ETH in its possession, price $13.25 billion.

Sharplink Gaming is available in second place with 838.7 thousand ETH price $3.93 billion, and The Ether Machine is available in third with 496.7 thousand ETH price $2.3 billion.

*This isn’t funding recommendation.