The crypto rally took a pause on Tuesday with bitcoin BTC$111,480.33 rapidly pulling again from file highs above $126,000 as analysts pointed to indicators of crypto rally overheating, at the very least within the quick run.

BTC plunged beneath $122,000, erasing the previous three days of positive factors and buying and selling 2.4% decrease within the 24 hours. The selloff rippled throughout the crypto market, with XRP$2.8211, DOGE$0.2316, ADA$0.7842 and AVAX$28.69 down 5%-7% in the course of the interval.

If the worth motion in bitcoin seems acquainted, that is as a result of it’s. Regardless of a 31% acquire year-to-date, bitcoin has given bulls little or no likelihood to bask of their wins. Every file excessive has seemingly been met with a fast and viscous sell-off. Think about the primary run to $109,000 simply forward of the Trump inauguration in January. That reversed decrease to $100,000 in hours and to $75,000 inside three months.

July’s first transfer above $123,000 was met with a couple of 10% decline over the next few days. And comparable surge above $120,000 in mid-August presaged a couple of 15% plunge in ensuing days.

The declines this time round got here after bitcoin’s near-vertical 16% pump off the late September lows beneath $109,000.

Jean-David Péquignot, CCO of choices market Deribit, projected in a Monday report that BTC might revisit the $118,000-$120,000 zone shaking out merchants who missed the lows and joined the rally late. If that pullback occurs, he mentioned, would provide a shopping for alternative as technicals and the macro setting aligns for BTC to run greater above $130,000 by way of the final quarter of the yr.

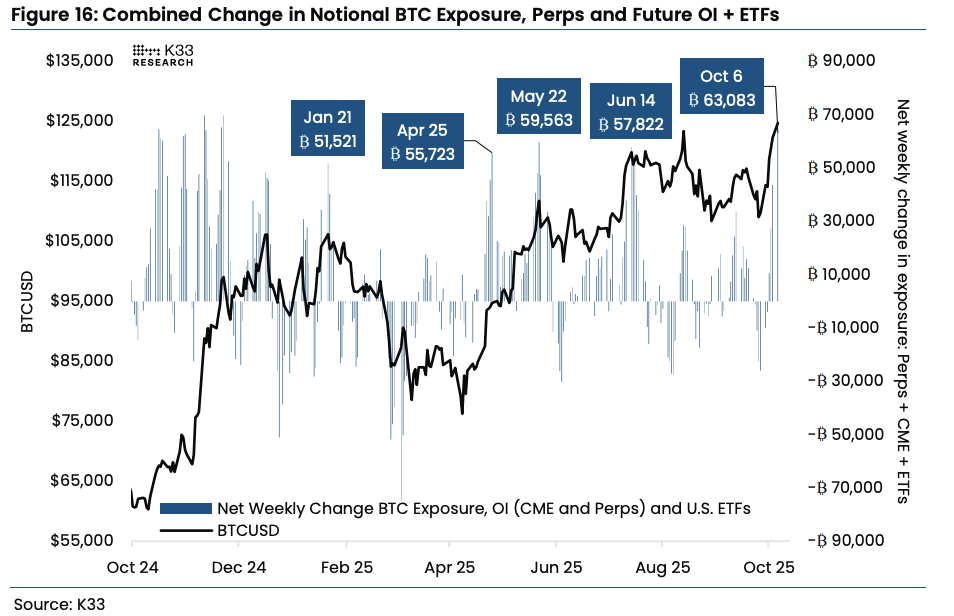

Derivatives market and ETF inflows additionally received overheated, mentioned Vetle Lunde, head of analysis at K33. He famous that the previous week marked the strongest BTC accumulation of the yr, with a mixed 63,083 BTC (value roughly $.7 7billion) added throughout U.S. ETFs, CME and perpetual futures, surpassing the Might peak. The surge was pushed by widespread lengthy positioning betting on greater costs and not using a clear macro catalyst, laying the bottom for a pullback.

“Traditionally, comparable bursts in publicity have usually coincided with native tops, and the present setup suggests a quickly overheated market with elevated threat of short-term consolidation,” Lunde mentioned.

Change in notional BTC publicity, combining perpetuals, futures open curiosity and ETF holdings (K33)

Fed’s Miran Says Impartial Price Ought to Be 0.5%

Federal Reserve Governor Stephen Miran — a current Trump appointee — mentioned Tuesday his view of the impartial rate of interest has shifted “from one finish of the vary to the opposite,” throughout a dialogue on the Managed Funds Affiliation Coverage Outlook 2025. He now believes the impartial charge ought to stand at 0.5%. Miran pointed to tighter immigration restrictions and evolving expectations concerning the federal deficit as the primary elements behind his reassessment.

Miran’s feedback recommend that long-term forces shaping the U.S. financial system are altering. A smaller labor pool might restrict development, whereas rising fiscal pressures may maintain the Fed’s balancing act between inflation and employment extra complicated. His remarks come as policymakers debate how a lot room the central financial institution has to chop charges with out reigniting value pressures.

Fed officers meet on the finish of this month to resolve a couple of potential additional charge reduce, nevertheless, with out essential knowledge coming from the federal government because the shutdown continues.

Miran additionally famous that financial development within the first half of the yr was weaker than anticipated, weighed down by uncertainty over commerce and tax coverage. However Miran struck a extra constructive tone for the months forward, saying a lot of that uncertainty has now cleared. “With clearer coverage alerts, I count on a steadier tempo of development,” he mentioned.

Crypto shares undergo

The broad pullback in crypto costs is hitting the associated shares, led by a 7% decline in Technique (MSTR) and a 4% loss for Coinbase (COIN). Ether ETH$4,005.03 treasury firms Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) are down 3% and seven%, respectively.

BItcoin miners are largely within the purple, led by MARA Holdings falling 4% and Riot Platforms (RIOT) 3%. Hut 8 (HUT) is decrease by 2%.